Latest Live in Care News

How do I fund Live-in Care?

Posted around 6 months ago •

Or copy link

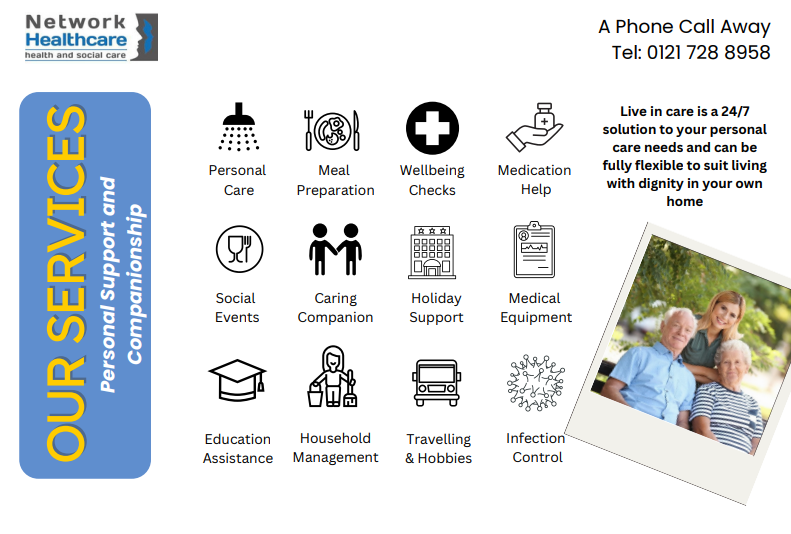

Live-in care is a type of care service that allows you or your loved one to stay at home with the support of a trained and dedicated carer. Live-in care can offer many benefits, such as:

- Maintaining your independence and dignity in your own home

- Having a personalised care plan that suits your needs and preferences

- Having a consistent and familiar carer who becomes part of your family

- Having companionship and emotional support

- Having flexibility and choice in your daily activities

- Avoiding the stress and disruption of moving into a care home

- Having peace of mind that you are safe and well looked after

However, live-in care can also be expensive, depending on your level of need and the quality of the service. The average cost of live-in care in the UK is around £1250 per week, but it can vary from £600 to £1,500 or more. Therefore, it is important to explore the different options for funding live-in care and find the best solution for your situation.

One of the options is to apply for financial assistance from the local council. This involves having a needs assessment and a means test to determine your eligibility and the amount of contribution you have to make. You might be eligible for the local council to pay towards the cost of your social care if you have less that £23,250 in savings. From October 2025, this will rise to £100,000 in savings. However, the council funding is limited and often only covers the basic level of care. You may also have to wait for a long time to get the funding approved and allocated. Therefore, many people choose to pay for live-in care privately or use a combination of sources.

Some of the other options for funding live-in care are:

- Using your personal income, savings, and/or investments. This gives you the most control and flexibility over your care, but it can also deplete your assets quickly and affect your inheritance.

- Using equity release, which is a way of releasing cash from your home without having to move. There are two types of equity release: lifetime mortgage and home reversion plan. Both have advantages and disadvantages, and you should seek professional advice before deciding on this option.

- Using an annuity, which is a type of insurance product that converts your savings into a regular income for life or a specified period. This can provide you with a guaranteed and tax-efficient income to pay for your care, but it also involves giving up your capital and losing access to your money.

- Claiming benefits, such as Attendance Allowance and Personal Independence Payment (PIP). These are non-means tested benefits that can help with the extra costs of living with a disability or illness. You can claim these benefits regardless of whether you receive council funding or not, and they can make a significant difference to your income.

- Applying for financial support as a carer, such as Carer’s Allowance and Carer’s Credit. These are benefits that can help you if you devote more than 35 hours per week to caring for a relative or friend. However, there are strict criteria and conditions that you have to meet to qualify for these benefits, and they may affect your other benefits or taxes.

As you can see, there are many factors to consider when choosing how to fund live-in care. The best option for you will depend on your personal circumstances, preferences, and goals. Therefore, it is advisable to do some research, compare different providers and services, and seek expert guidance before making a decision. You can also use some online tools and calculators to estimate your care costs and funding options.

To help you get started, here are some useful websites that offer more information and advice on live-in care and funding:

- Network Live In Care - This is a website that provides comprehensive information on live-in care, including what it is, how it works, what it costs, and how to find a suitable carer. It also has a free consultation service with Quality Care Advisors

- UK Care Guide - This is a website that offers guidance and support on various aspects of care, including live-in care, care homes, home care, and dementia care. It also has a section on funding care, where you can find out more about the different options and sources of funding, as well as a free online care funding calculator that can help you estimate your care costs and eligibility for funding.

- Live In Care Organisation - This is a website that promotes the benefits of live-in care and helps you find a suitable live-in care provider in your area. It also has a section on funding live-in care, where you can learn more about the council funding process, the benefits you can claim, and the equity release schemes.

- Helping Hands Home Care - This is a website of one of the leading live-in care providers in the UK, with over 30 years of experience and expertise. It offers high-quality and personalised live-in care services, as well as other types of home care, such as hourly care, respite care, and specialist care. It also has a section on funding live-in care, where you can find out more about the costs, the benefits, and the funding options, as well as a free online care cost calculator that can help you plan your budget.

- Home Instead - This is another website of a reputable live-in care provider in the UK, with over 20 years of experience and a network of local offices. It offers bespoke and flexible live-in care services, as well as other types of home care, such as companionship care, personal care, and dementia care. It also has a section on funding live-in care, where you can learn more about the costs, the benefits, and the funding options, as well as a free online care consultation service that can help you find the best solution for your needs.

I hope this information is helpful and gives you some insight into live-in care and how to fund it. If you have any further questions, please feel free to ask me. I am always happy to help. 😊

Gavin Chase, Director of Brand Partnerships, Network Healthcare 0121 728 8958