Latest Live in Care News

Care Funding, Pricing and Planning. How to fund long-term care is a big consideration.

Posted around 9 months ago •

Or copy link

When looking at funding care, depending on your personal circumstances, you may be able to access public funding or benefits, or other financing options.

If you’re funding your care yourself because you fall outside the threshold laid down by UK law, it’s still worth looking into whether any benefits are available to you.

We’ve pulled together the common questions customers ask us about funding care.

Long-term care is a crucial aspect of life that requires careful planning and financial preparation. The cost of long-term care can be quite high, and it is essential to explore alternative funding options to ensure that you are adequately covered.

One of the most common alternative funding options for long-term care is self-funding. This involves using your own savings, investments, or other assets to pay for your care. Some suggest that you can also consider selling valuable items such as art or antiques, or checking for insurance policies that could cover care costs.

Another option is long-term care insurance. This type of insurance is designed to cover the costs of long-term care, including nursing home care, assisted living, and in-home care (aka live in care). Long-term care insurance policies can vary widely in terms of coverage and cost, so it’s essential to do your research before choosing a policy and it may be too late to consider this as an option with premiums rising as we age.

Reverse mortgages, or equity release schemes, are another alternative funding option for long-term care. This type of mortgage allows you to borrow money against the equity in your home. The loan is repaid when you sell your home or pass away but be cautions that reverse mortgages can be expensive and may not be the best option for everyone. Use a specialist financial advisor to ensure that you are fully aware of your options.

Certain life insurance policies can also be used to fund long-term care. These policies allow you to access a portion of your death benefit while you are still alive to pay for long-term care expenses. It should be noted that these policies can be complex and may have high fees, so it’s important to understand the terms and conditions before purchasing one.

Finally, annuities can also be used to fund long-term care. An annuity is a financial product that provides a guaranteed income stream for a set period or for life . Some annuities offer long-term care benefits as part of their package.

In conclusion, there are several alternative funding options available for long-term care. Self-funding, long-term care insurance, reverse mortgages, certain life insurance policies, and annuities are all viable options depending on your financial situation and needs. It’s essential to do your research and consult with a financial advisor before making any decisions about how to fund your long-term care.

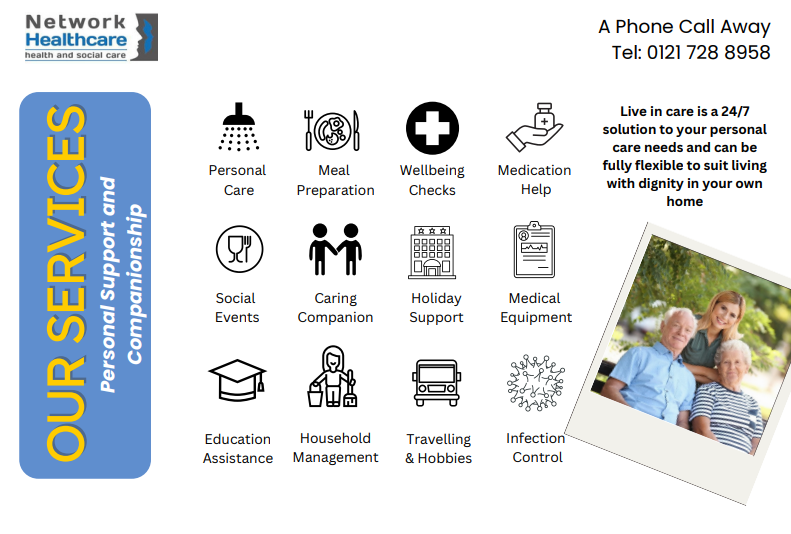

If you’re interested in finding out about Live in Care or a level of homecare visits, reach out to our Quality Care Advisors. In the first instance call 0121 728 8958 or email gavin.chase@networkhsc.co.uk